Resources for your Dealership

Motor Vehicle Rules (Advertising Rules - R877-23v-7)

PDF of Utah Rules & Regulations for the automotive industry.

Click Here. (Rev 01-23)

Motor Vehicle Business Regulations Act

PDF of Utah law for motor vehicle dealers (Rev 01-23)

New Automobile Franchise Act

PDF of the Utah New Automobile Franchise Act (Rev 01-23)

Attorney

Bryan Fishburn

Fishburn & Associates

4505 Wasatch Blvd E # 215, Salt Lake City, UT 84124

(801) 277-3445

Richard Madsen II

Ray Quinney & Nebeker P.C.

36 South State Street, Suite 1400, Salt Lake City, Utah 84111

(801) 323-3392

bonds & Insurance

Get a discount on your insurance with someone that knows the automotive industry. Are you not sure if your properly insured, or just want to make sure your agent is writing your insurance correct for the automotive industry, call Vernon Insurance for a free quote.

Curtis J Vernon Insurance

46 West 200 South, Bountiful, UT 84010

ph: 801.292.5529

Security Cameras

Security Integrators, LLC

Brooks Walker

brooks@securityint.biz

801-430-2614

Security Camera systems: Brands: Ic Realtime, Clare Vision, Ring, Google/Nest

DEALER management System (DMS) Software

The following DMS providers are recommended for use by dealers in Utah and include access to the forms that IDS offers to our clients.

DealerTrack

DealerTrack currently offers all the IDS forms in their system. They offer more than DMS/CRM solutions including F&I, lenders, and more.

Reach out to them at www.us.dealertrack.com

DEALER PLATE USE

The allowable use of dealer plates is very broad based. 41-3-501

Dealer plates may not be used:

on a vehicle leased or rented for compensation; the vehicle must be licensed and registered in the name of the business in order to be leased or rented; or

in lieu of registration, on a motor vehicle sold by the dealer; an example would be if a temporary permit had expired in place of renewing that registration;

on a loaded commercial vehicle over 26,000 pounds gross laden weight unless a special loaded demonstration permit is obtained from the division in accordance with Section 41-3-502

doc fee signage & spreadsheet

Utah law requires that a dealer post their doc fee sign in their dealership in the areas that conduct any part of the financing and sale of the vehicle. This includes salesman offices, and finance offices. The language required on the signage is outlined in Utah rule. Download a free PDF of the sign required. Simply write the correct doc fee amount on the provided line and hang the sign.

IDS has provided a Doc Fee Spreadsheet to help you determine the appropriate doc fee based on your overhead, documents, and paperwork required for titling and registering a vehicle. The spreadsheet is an excel document that you can input your overhead, costs, and salaries to help determine your doc fee amount.

Emissions and Registration Fees Charts

Links below are to the State Emissions Charts and the MVED & Registration Fee Charts for the year 2023.

Emissions Chart 2024 (PDF)

Fee Charts 2024 (PDF)

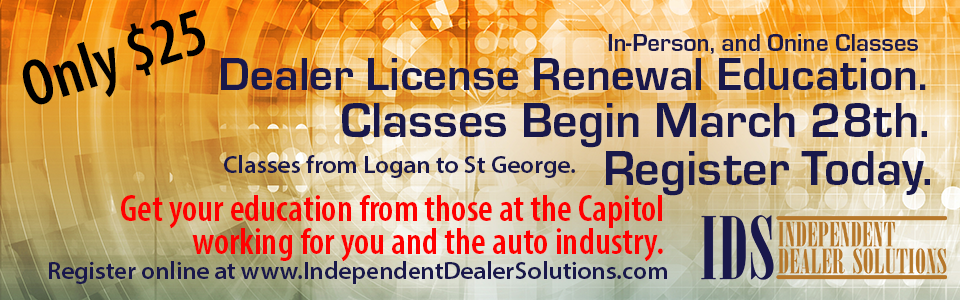

Renewal Education Classes

As a customer of IDS you receive your dealer renewal education for a discounted rate. Thanks to our partners, we continue to lower the price of education to provide you with the best and most affordable education available. Make sure your education is provided by those at the Capitol working for you.

Entertainment, Hotel, and Tickets Discounts

***Coming Soon***

Legislation & Government Relations

We are at Utah’s Capitol Hill each day during the legislative session and during the interim sessions to keep you up to date on what is happening. During the legislative session we will send you a regular legislative update email, with changes, updates, and will ask for your feedback on what is happening. Your voice needs to be heard. If you aren’t receiving these updates, please email or call us.

Odometer Disclosure & Exemption

On October 2, 2019, the National Highway Traffic Safety Administration (NHTSA) issued a final rule on Odometer Disclosure Requirements. One of the most important and immediate impacts of the final rule are new requirements regarding the capture of mileage disclosure for a significant number of previously exempted vehicles.

The final rule amends 49 CFR 580.17 such that a transferor or lessee must disclose odometer mileage for an expanded number of vehicles extending beyond the previous exemption for vehicles with a model

year of ten years to twenty years.

PRIVACY RULE

Do you have a privacy policy in your dealership. If not, we can make it easy for you. Complete the Privacy Policy Worksheet from the link below and email it back to us at info@idsinfo.com and we will create the Privacy Policy specific to your dealership. We will print them for you in a package of 100 for our member price of $11.25/pkg.

Recalls

Vehicle recalls are currently not required to be fixed before a vehicle is sold, however we suggest that you notify the customer of current open recalls on the vehicle the customer is considering to purchase. Search the NHTSA website below. IDS offers a Vehicle Recall Disclosure Statement for purchase. Call and order yours today. 801.566.3802.

NHTSA Vehicle Recall Search

Safeguards Rule

The Safeguards Rule is one of several federal regulations concerned with the protection and safekeeping of consumers’ private personal information. Like the Privacy Rule, the Safeguards Rule derives from the Gramm-Leach Bliley Act, often referred to as the Privacy Act.

As implemented by the Federal Trade Commission (FTC), the Safeguards Rule requires financial institutions, which includes all dealers, to develop, implement, and maintain a comprehensive information security program. The program must be in written format and must contain administrative, technical and physical safeguards appropriate to your business - such as car dealers - involved in the extension of credit or in activities related to the extension of credit.